An HR audit is a critical process that helps businesses maintain compliance, improve efficiency, and optimize their human resource functions. A thorough HR audit ensures that an organization adheres to employment laws, aligns with industry standards, and effectively manages its workforce. By systematically reviewing a company’s policies, procedures, and records, they can identify potential risks, streamline operations, and create a more supportive work environment.

Conducting regular HR audits is essential for any organization aiming to maintain compliance with regulatory requirements, enhance employee satisfaction, and minimize legal risks.

Key Areas of an HR Audit Checklist

Key Areas of an HR Audit Checklist

A comprehensive HR audit should cover all essential areas of human resource management to ensure regulatory compliance and efficiency. The following components should be evaluated:

Legal Compliance and Record Keeping

Employment Laws

- Is the company in full compliance with the Fair Labor Standards Act (FLSA), the Americans with Disabilities Act (ADA), the Equal Employment Opportunity Commission (EEOC) guidelines, and other applicable laws?

- Are policies in place to prevent workplace harassment, discrimination, and retaliation?

- Are all required labor law posters displayed and up to date?

Employee Handbook and Policies

- Is the employee handbook regularly updated to reflect changes in employment laws and company policies?

- Do employees fully understand company policies and expectations?

- Are anti-discrimination, harassment prevention, and workplace safety policies clearly outlined?

HR Records and Documentation

- Are all employee files up to date, securely stored, and compliant with record-keeping regulations?

- Are records related to hiring, promotions, terminations, and disciplinary actions properly documented?

- Are timekeeping and payroll records accurate and compliant with wage and hour laws?

Recruiting and Hiring Practices

- Do job descriptions accurately reflect the responsibilities, qualifications, and expectations of each role?

- Is the hiring process structured, consistent, and compliant with employment regulations?

- Are background checks conducted in accordance with legal guidelines, and are interview questions compliant with anti-discrimination laws?

- Are new hire onboarding procedures thorough and aligned with best practices?

Compensation and Employee Benefits

- Are employee salaries competitive, free of wage gaps or biases, and compliant with minimum wage laws?

- Are executive compensation packages structured fairly and transparently?

- Are employee benefits packages—including health insurance, retirement plans, and paid leave—competitive and clearly communicated?

- Are payroll processes reviewed regularly to ensure compliance with tax and labor laws?

Employee Training and Development

Training Programs

- Are employees receiving effective training tailored to their job roles and company policies?

- Are compliance training programs in place for workplace harassment, diversity and inclusion, and cybersecurity awareness?

- Is training tracked and documented to ensure completion and compliance?

Professional Growth Opportunities

- Are there structured career development programs that provide employees with opportunities to advance within the company?

- Is there a mentorship or leadership development initiative to cultivate future company leaders?

- Are employees encouraged to pursue continuing education and professional development?

Performance Management and Employee Relations

- Is there a structured performance management system in place to assess employee progress and provide feedback?

- Do employees receive regular performance reviews with documented outcomes?

- Does the company have a fair and transparent system for managing employee grievances and resolving workplace disputes?

- Is there an effort to measure and improve employee satisfaction and engagement through surveys or other feedback mechanisms?

HR Processes and Technology

- Are HR policies and procedures clearly documented and reviewed regularly?

- Is HR software being used effectively for managing employee records, payroll processing, and compliance tracking?

- Are automation tools utilized to streamline HR processes and reduce administrative burden?

- Does the organization have a disaster recovery plan in place for HR records and data security?

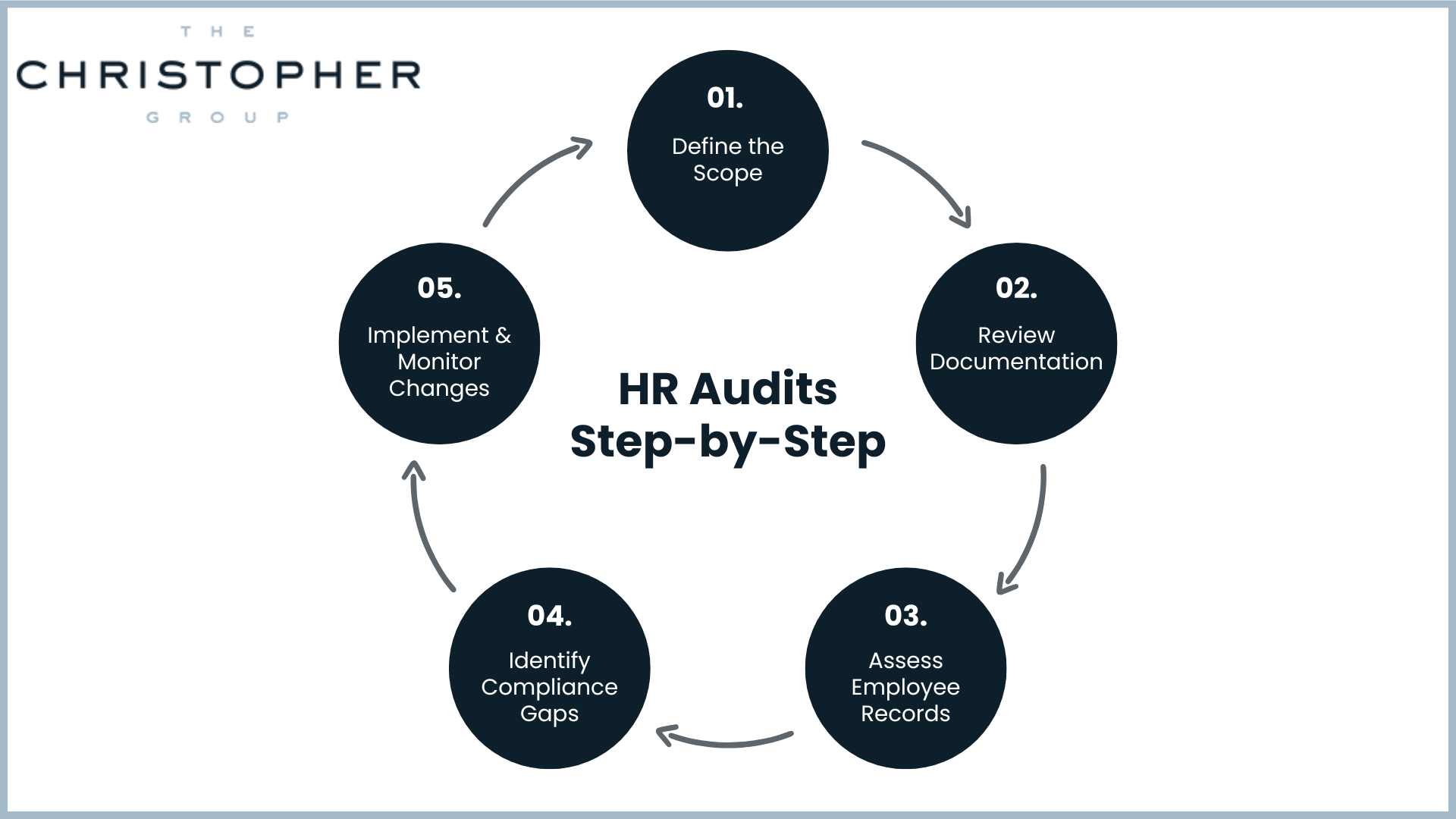

Conducting an HR Audit: Step-by-Step Guide

Step 1: Define the Scope of the Audit

- Decide whether the HR audit will be conducted internally or with the assistance of HR professionals.

- Identify the primary focus areas, such as legal compliance, payroll accuracy, or hiring procedures.

- Set clear objectives to ensure a structured and efficient audit process.

Step 2: Review HR Documentation

- Examine HR policies, employee handbooks, and job descriptions to ensure alignment with company objectives and legal requirements.

- Check for any outdated policies that need to be revised or removed.

- Ensure documentation is thorough and consistent across all departments.

Step 3: Assess Employee Records and Benefits

- Verify that all personnel files are properly maintained, with secure and confidential storage.

- Review payroll records for accuracy in salary administration, tax withholding, and overtime pay.

- Assess benefit plans to ensure they are competitive and compliant with industry standards.

Step 4: Identify Compliance Gaps and Risks

- Conduct an in-depth analysis of HR procedures to identify potential compliance risks.

- Compare current practices against industry best practices and legal requirements.

- Pinpoint inconsistencies or weaknesses that may lead to legal exposure or operational inefficiencies.

Step 5: Implement and Monitor Changes

- Develop an action plan to strengthen HR policies and processes based on audit findings.

- Implement necessary changes to address identified areas for improvement.

- Schedule follow-up audits to ensure continuous compliance.

- Minimize legal risks through ongoing evaluation and adjustments.

Best Practices for HR Compliance & Risk Management

Best Practices for HR Compliance & Risk Management

To maintain compliance and mitigate risks, companies should adopt best practices that ensure long-term HR success:

- Conduct Regular HR Audits: A proactive approach helps organizations detect and correct compliance issues before they escalate into costly problems.

- Keep HR Departments Informed: HR professionals must stay updated on employment laws, wage regulations, and new compliance requirements to ensure legal compliance.

- Utilize a Formal HR Compliance Checklist: A structured HR audit checklist ensures alignment with best practices and regulatory requirements.

- Invest in Ongoing Employee Training: Consistent training programs improve employee satisfaction, reduce compliance risks, and enhance overall workplace safety.

Why Work with HR Experts for a More Effective HR Audit

Conducting an internal audit can be overwhelming, especially when dealing with evolving compliance regulations. Partnering with HR professionals helps businesses navigate complex HR processes and ensure a thorough evaluation of their HR function.

The Christopher Group’s Expertise

The Christopher Group specializes in HR executive search, talent acquisition, and HR compliance consulting. Our expert team provides fractional CHROs, interim HR leaders, and advisory services to help companies refine their HR operations and maintain compliance with industry standards.

With a strong focus on diversity, equity, and belonging, The Christopher Group helps organizations build high-performing HR teams that drive sustainable business success.

A well-executed HR audit is an essential tool for businesses aiming to enhance compliance, streamline HR functions, and reduce legal risks. By leveraging an effective HR audit checklist and working with HR professionals, companies can create a proactive HR strategy that fosters growth and operational efficiency.

If your HR team needs expert support in conducting a comprehensive HR audit, The Christopher Group is ready to provide tailored solutions that enhance HR function and long-term success. Schedule a free consultation today to get started.